Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) is a huge change to how self-assessment will work for unincorporated businesses such as landlords and the self-employed. These rules will change how you will keep your records, when you submit your tax returns to HMRC and will affect an estimated 1.6 million sole traders, landlords and partnerships.

The rules mean businesses and landlords with annual income above £50,000 will need submit income tax information following the MTD rules starting on or after 6th April 2026. Those with income over £30,000 will be mandated from April 2027. If either of these apply to you, your accounting records will need to be kept digitally and sent to HMRC digitally after the end of each quarter.

On December 19th 2022, Parliament released a statement confirming that Making Tax Digital for Income Tax Self Assessment (MTD ITSA) will be delayed for two further years. This delay is something of a gift, so if you’re reading this right now, you are in a very good position to get the help you need to change to digital. Here’s a brief guide to what MTD ITSA is and what you can do right now to get ready:

An obvious question here is “Why?”

Errors and avoidable mistakes cost HMRC an estimated £9 billion per year in uncollected taxes. Keeping information as real-time as possible reduces errors. Making Tax Digital is part of a reform of taxes across all business which started with VAT and will extend to include Corporation Tax in the next phase.

So what are the new rules?

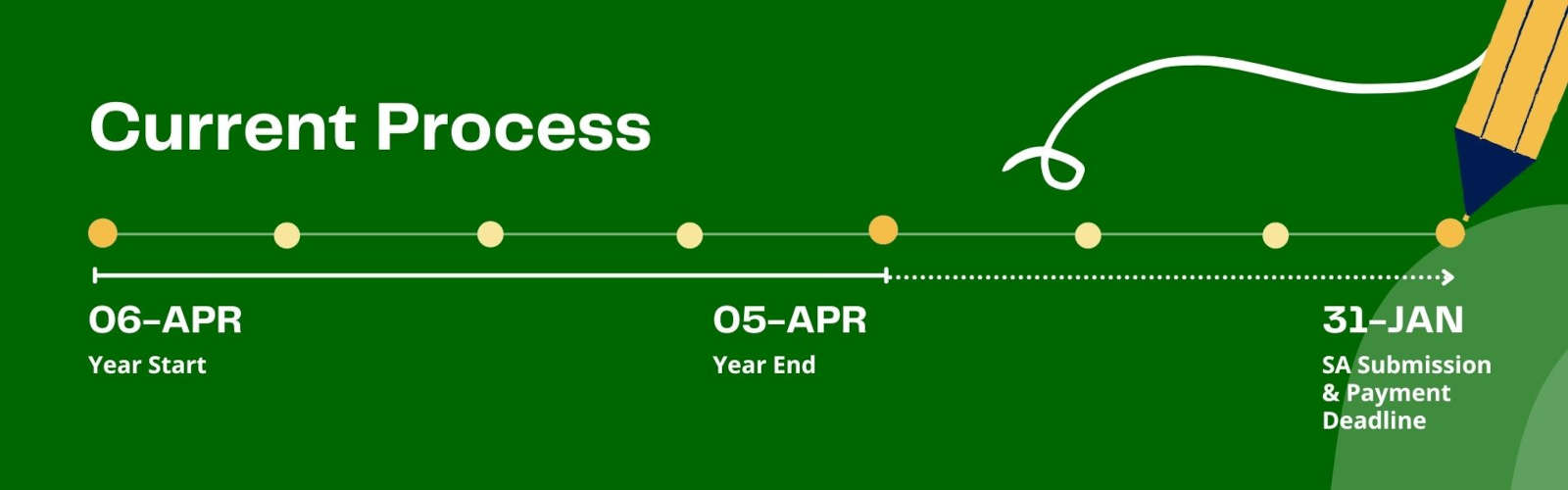

Let’s take a look at the current process.

Assuming you are on a standard tax year (and more about that later), you earn money between 6th April one year and 5th April the next. This is then reported by Self Assessment tax return before 31st January the following year. So if you complete your self-assessment right on the deadline, that’s around 10 months after your year end and a whopping 22 months before the start of that tax year. You can start to see how it would be easy to make mistakes when looking that far back.

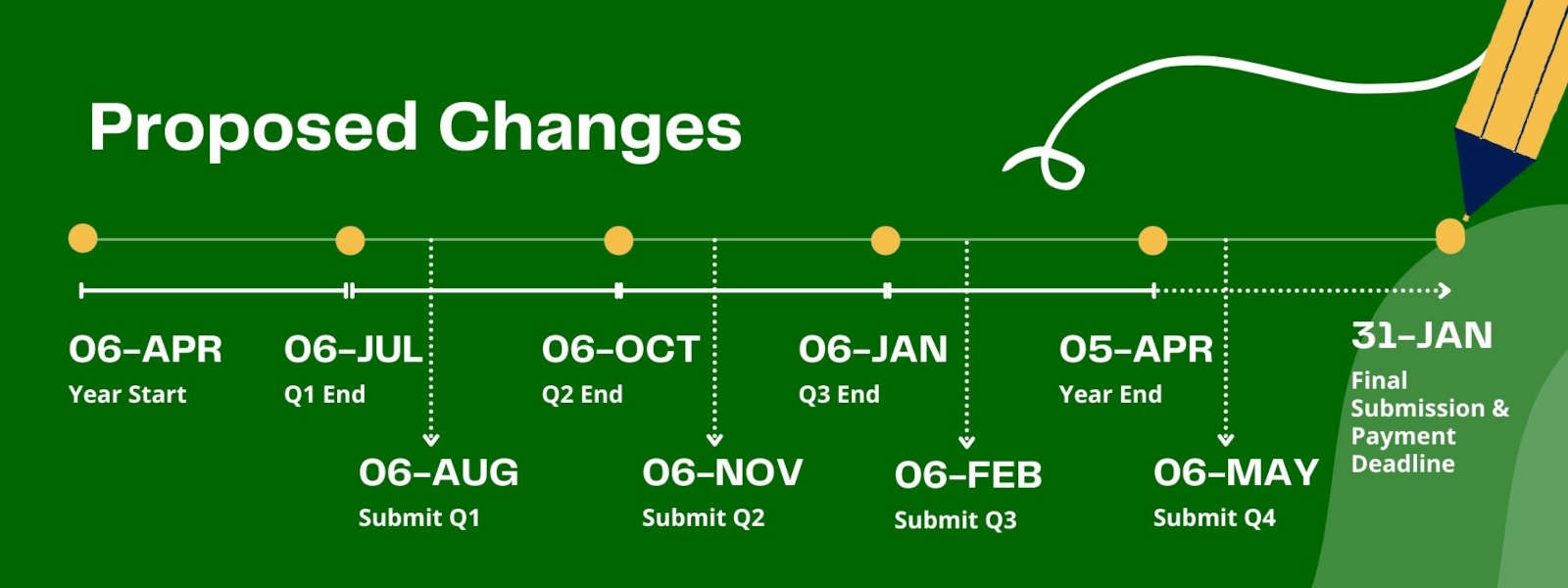

Now let’s take a look at what will change.

The proposed changes split the year into 4 quarters starting on 6th April. At the end of each quarter you will have 30 days to submit a return to HMRC so before 6th August, you must send your return covering 6th April – 5th July. Remember, the accounts must be kept and sent digitally. As well as these 4 quarterly returns, there will also be a final return similar to the current self assessment which ties all the information together and includes your income details from other sources e.g. pensions, employment etc. Any tax owed is also due on the 31st January of the following year after the tax year end. This doesn’t change under MTD.

Does it affect me?

If you’re an unincorporated business (a sole trader, partnership or landlord) with a total turnover above £30,000 then yes it does. Here’s what will change for you:

- Your business records will need to be kept and sent to HMRC digitally. Realistically this means you will need accounting software for each business. i.e. if you’re a sole trader with a rental property you will need two accounting software accounts (these can be on the same software).

- Your accounting software may need a digital bank feed, as in you need to connect your business bank account to the accounting software. This means you could need a separate business bank account (for each business).

- Your tax year may need to change. If you don’t currently make your accounts up to 5th April (or 31st March) each year you will need to change your accounting dates. This will most likely mean sending a long or short tax return, which could mean additional tax to pay.

So what steps do you need to take to get ready?

You will need accounting software:

Moving to digital isn’t easy, especially if you’re part way through the business year, however if you have a very simple business, or a good grasp of the accounts, you may be able to manage this yourself. Moving as soon as is practically possible has a lot of advantages including:

- You will gain peace of mind from knowing everything is correct; the addition, rounding and completeness of information (especially with a business bank account connected).

- There are many benefits of software such as invoicing with ease, tracking if payments have been made, chasing those that haven't and reporting easily on the business finances. Usually adopting software will reduce your admin time if you’re moving from paper or even spreadsheets/documents.

- Accountants and bookkeepers are more likely have time to help you the sooner you decide to make the move.

To help small businesses comply with the making tax digital rules, HMRC have committed to provide free software for businesses who meet all of these conditions:

- it is unincorporated (for example self-employed persons or landlords)

- it has turnover within the scope of Income Tax below £85,000

- it has no employees

- it uses cash basis accounting*

However, there is no expectation that a free product will include VAT so if you’re VAT registered, free software is unlikely to be an option.

Some bank accounts provide you with free software (see below) . If you don’t qualify for free software, you can expect to pay between £10 and £40 per month, depending on what functionality you need. If you need help to decide on software please get in touch and we can chat through the options.

* You can see if you use Cash Basis accounting by looking on your previous tax return. Look at Box 8 on the Self-employment pages, and/or Boxes 5.2 and 20.2 on the UK property pages.

You will probably need a separate business bank account

Bank accounts can usually be linked to your accounting software, meaning the lines on your bank statement are automatically fed into the accounts.

If you use a personal account, you will spend extra time and/or money explaining away the transactions that don’t belong to the business.

Some business bank accounts offer free access to accounting software. FreeAgent software is free of charge to Natwest, RBS & Mettle Business Banking Customers

You may want to change your Year End Date

If your business year ends on a date that isn’t 31st March up to 5th April, "Basis Period Reform" is happening in advance of the introduction of the MTD ITSA rules. In brief this will mean you report an extra long tax year starting and pay the associated tax.

There may be ways to reduce this potentially large tax bill – by deducting overlap profits if you have them, or by spreading the cost over 5 years.

Tax year 2023-2024 is the transition year for Basis Period Reform so if this affects you, read more on the link below:

* 25/02/22 Basis Period Reform

Consider engaging a bookkeeper or accountant now

If digital isn’t your thing, or you will need help to get going, now is the time to find yourself someone who can help. You can plug your postcode in here to find a local bookkeeper.

If that happens to be me, get in touch.

For Reference:

An Overview of Making Tax Digital. Updated 19 December 2022

Policy paper on Basis period reform. Published 27 October 2021

Previous Blogs

- 18/11/22 VAT Penalty Reform

- 06/09/22 Accounting Software: What's in it for me?

- 15/07/22 Transitional Year Profits, Overlap Relief and Spreading Profits

- 25/02/22 Basis Period Reform

- 25/01/22 Should I pay Voluntary Class 2 National Insurance Contributions (NIC)?

- 23/11/21 Self assessment: What is payment on account?

- 12/10/21 Why does HMRC need to know about interest on my self assessment tax return?

- 12/09/21 What does a bookkeeper do?