IF YOU'D PREFER TO READ IT...

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) is a set of upcoming changes to the Self Assessment tax system. The legislation states that from 6th April 2024 sole trasers and landlords with a total annual business turnover over £10,000 will have to follow the Making Tax Digital rules. General partnerships will need to follow the rules from 6th April 2025. These rules will change how you keep your records, when you submit your tax returns to HMRC and will affect sole traders and partnerships.

Your accounting records will need to be kept digitally and sent to HMRC digitally after the end of each quarter.

An obvious question here is “Why?”

Errors and avoidable mistakes cost HMRC an estimated £9 billion per year in uncollected taxes. Keeping information as real-time as possible reduces errors. Making Tax Digital is part of a reform of taxes across all business which started with VAT and will extend to include Corporation Tax in the next phase.

So what are the new rules?

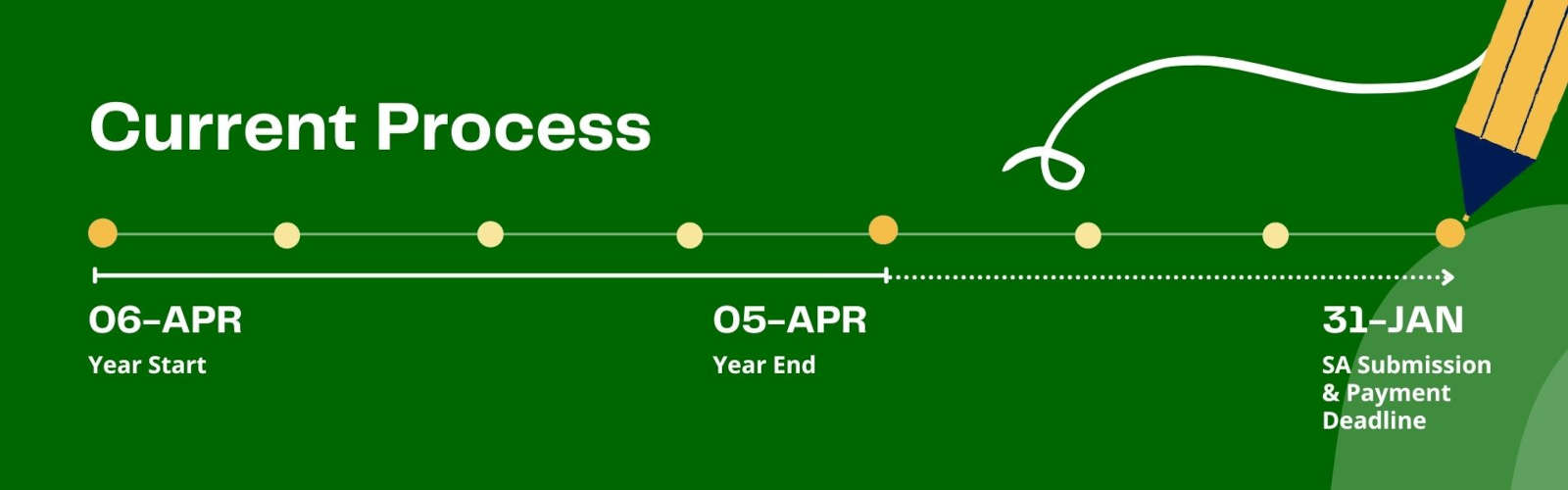

Let’s take a look at the current process.

Assuming you are on a standard tax year (and more about that later), you earn money between 6th April one year and 5th April the next. This is then reported by Self Assessment tax return before 31st January the following year. So if you complete your self-assessment right on the deadline, that’s around 10 months after your year end and a whopping 22 months before the start of that tax year. You can start to see how it would be easy to make mistakes when looking that far back.

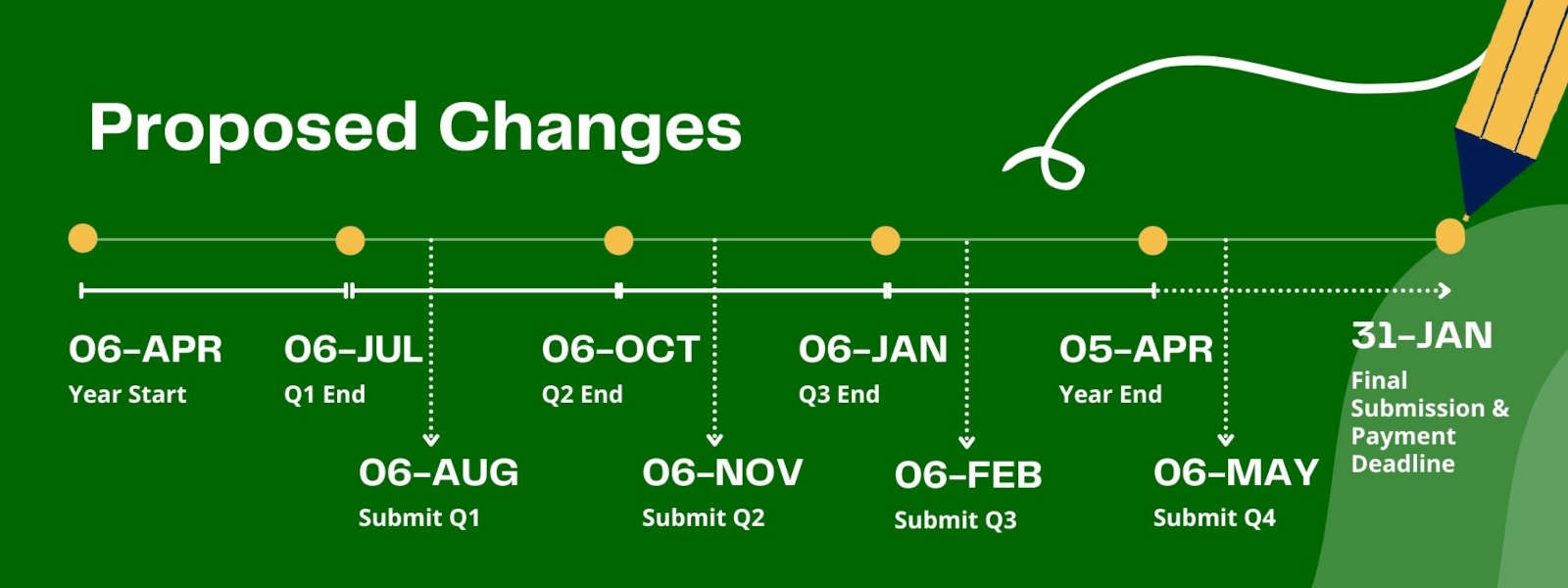

Now let’s take a look at what will change.

The proposed changes split the year into 4 quarters starting on 6th April. At the end of each quarter you will have 30 days to submit a return to HMRC so before 6th August, you must send your return covering 6th April – 5th July. Remember, the accounts must be kept and sent digitally. As well as these 4 quarterly returns, there will also be a final return similar to the current self assessment which ties all the information together and includes your income details from other sources e.g. pensions, employment etc. Any tax owed is also due on the 31st January of the following year after the tax year end. This doesn’t change under MTD.

Does it affect me?

If you’re an unincorporated business (a sole trader, partnership or landlord) with a total turnover above £10,000 then yes it does. Here’s what will change for you:

- Your business records will need to be kept and sent to HMRC digitally. Realistically this means you will need accounting software for each business. i.e. if you’re a sole trader with a rental property you will need two accounting software accounts (these can be on the same software).

- Your accounting software may need a digital bank feed, as in you need to connect your business bank account to the accounting software. This means you could need a separate business bank account (for each business).

- Your tax year may need to change. If you don’t currently make your accounts up to 5th April (or 31st March) each year you will need to change your accounting dates. This will most likely mean sending a long or short tax return, which could mean additional tax to pay. There will be more details on this when the legislation is put into law.

It sounds expensive!

But it doesn't have to be. Let's take a look at the extra costs;

- Bookkeeping. Your business income and expenses need to be recorded as close to real-time as possible to avoid errors and mistakes. This means your books will need to be kept up to date at least quarterly in order to send the quarterly submission. This could mean paying a professional, like a bookkeeper, or taking the time to do this yourself.

- Accounting Software will often incur monthly costs but there are many benefits such as quick invoicing, estimates and storage of all your invoices, bills and receipts. Some software is available free of charge via your bank account and HMRC have committed to providing free software to those “with the simplest tax affairs”. As yet it hasn’t been defined who will be eligible for the free software but it is expected to mean the lowest income bracket.

- Business Banking can often incur a monthly charge. Some accounts are free, such as Starling and Mettle. Also Natwest, RBS and Mettle offer a fully funded version of FreeAgent’s accounting software to their business banking customers. A Mettle account can effectively give you business banking and accounting software for free.

April 2023 may seem a long way away but by March 2024 every bookkeeper and accountant in the land is going to be busy helping their existing clients to get ready to follow the Making Tax Digital rules. If you need help with software options, and/or regular bookkeeping, please get in touch.

NB: If you’re an existing client and this affects you I will be in touch with you to help you plan what needs to be done. Just sit tight and watch your inbox.

For Reference:

An overview of Making Tax Digital on GOV.UK

Written Ministerial Statement made on 23 September 2021 on parliament.UK