Companies House are set to make significant changes to the way accounts will be filed with them in future. If you’re a small or micro limited company, these could affect you.

Why?

The changes are due to the Economic Crime and Corporate Transparency (ECCT) Bill which reached Royal Assent to become law on 26th October 2023. The Bill gives more powers to Companies House and requires them to improve the accuracy of information they hold. In order to do this Companies House will be verifying identity and ending web and paper filing amongst other changes.

Tell me more about the changes

There are several changes which have been announced so far:

- Identity Checks – In a bid to crack down on false information, Companies House will be verifying the identity of all new and existing company directors, secretaries and people with significant control as well as those who file on behalf of companies (such as your tax agent). This will mead providing documents that confimr your identity and address.

- Improving accuracy (1) - The ability to file abridged accounts will be removed. This means that all small companies, including micro-entities, will be required to file their profit and loss accounts in addition to the balance sheet which is currently required. This move is to improve transparency, reduce opportunities for fraud and to make creditworthiness easier to assess.

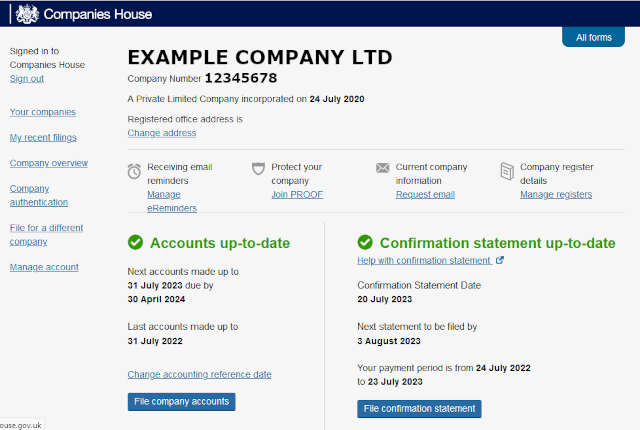

- Improving accuracy (2) – Also, Companies House will remove the option to file via their web-filing (online) service, or by paper, meaning the only way to file will be through specific software. You may already have the ability to file straight to Companies House through your accounting software, if not you will need new software or a tax agent (such as a bookkeeper or accountant) to file for you.

- Improving accuracy (3) – If a company relies on an audit exemption, the Director(s) will be required to provide an additional statement on the balance sheet, confirming the exemption being relied upon, and that the company meets the qualifying criteria.

- Improving accuracy (4) – In addition, the Registrar will have the power to require all component parts of a filing to be delivered together to facilitate the digital filing of more complex accounts.

- Improving accuracy (5) – Lastly, Companies House will be able to limit the number of times a company can shorten its Annual Reporting Period.

- Fees will be reviewed – Having more investigation and enforcement powers will increase the workload at Companies House. Companied House do not make a profit on fees, it is simply cost recovery. However, as it currently costs as little as £10 to incorporate a company and just £13 each year to file a confirmation statement, it would be safe to assume these fees will increase in line with the increased workload undertaken.

When will all this happen?

Companie House say, "Although the Bill has received royal assent and is now an act, you do not need to do anything differently just yet. Some of the measures in the act, such as identity verification, will not be introduced straight away". Keep your eyes on the LATEST NEWS for when the changes are introduced.

For Reference:

Changes to UK company law: a big moment for Companies House

Changes to accounts, part 1: moving to software-only filing

Changes to accounts, part 2: small company filing options

Reviewing Companies House fees

Guidance: Companies House fees

Economic Crime and Corporate Transparency Bill

Previous Blogs

- 23/06/23 Overlap Relief is ending

- 28/04/23 Help! I need an SA302!

- 22/02/23 Cashflow in a recession*

- 20/01/23 Getting Ready For Making Tax Digital for Income Tax Self-Assessment MTD ITSA

- 18/11/22 VAT Penalty Reform

- 06/09/22 Accounting Software: What's in it for me?

- 15/07/22 Transitional Year Profits, Overlap Relief and Spreading Profits

- 25/02/22 Basis Period Reform

- 25/01/22 Should I pay Voluntary Class 2 National Insurance Contributions (NIC)?

- 23/11/21 Self assessment: What is payment on account?

- 12/10/21 Why does HMRC need to know about interest on my self assessment tax return?

- 12/09/21 What does a bookkeeper do?