IF YOU'D PREFER TO READ IT...

If your business accounts use a different year to the standard tax year, a change is coming for the self employed (and partnerships) which will affect your trading profits and tax due in 2023-2024. Here’s what you need to know:

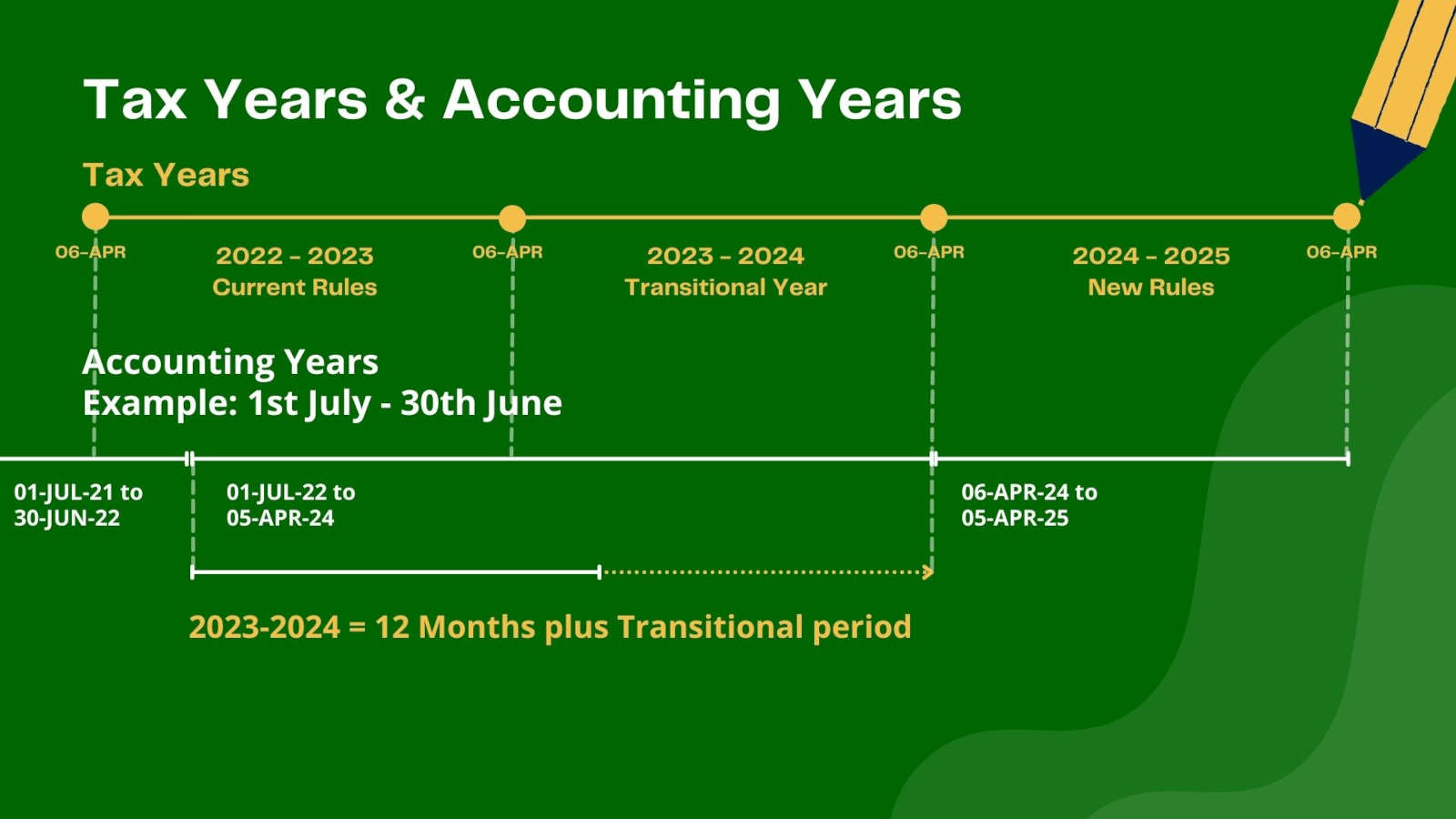

The change is called Basis Period reform, and it means all ‘basis period’ rules will be abolished in tax year 2024-2025,starting on 6th April 2024. In simple terms, if your self-employed business calculates yearly profits using different dates to the standard tax year*, you will be affected. *The standard tax year is 6th April to 5th April the following year.

How would I know?

The simple way is to check your last self assessment tax return. Look at the Self-employment pages.

- If you use the short version (it will say so at the top) the last day of your business year is shown in box 7 “Date your books or accounts are made up to”

- If you use the full version (again it will say at the top) the last day of your business year is shown in box 9 Date your books or accounts are made up to or the end of your accounting period.

If the date shown is 5th April (or any day from 31st March to 4th April) you can stop reading, this won’t affect you at all. If it’s a different date, you will either have to change your accounting date (the year end) or calculate your business profits differently for April 2023 – April 2024.

What has changed?

Starting on 6th April 2024 your taxable profits will be assessed on the same dates as the tax year*. The tax year 6th April 2023 – 5th April 2024 is a transitional year where you report profits from the start of your usual tax year up to the 5th April. So if your business profits are calculated for 1st July – 30th June, you will have to report an extra 9 months in this year – 1st July 2022 – 5th April 2024.

Using the example above:

Tax Year 2022 - 2023 is under the current rules so you pay tax on your trading profit for 1st July 2021 - 30th June 2022, as normal.

Tax Year 2023 - 2024 is a transition year so you pay tax on your trading profit for 1st July 2022 - 5th April 2024

Tax Year 2024 - 2025 is under the new rules so you pay tax on your trading profit for 6th April 2024 - 5th April 2025

Under the new rules everyone is reporting trading profits for the same period, regardless of when their business accounts are made up to.

*There are ‘Equivalence’ rules which mean if the last day of your year is from 31st March – 4th April you can report this as the same as the tax year without making any adjustments.

That puts a lot of profit in 2023-2024!

Indeed it does but there are a couple of ways to reduce the tax bill for that year:

Using our example of accounts made up to 30th June, the first 12 months (1st July 2022 to 30th June 2023) is treated a usual and added to your trading income. The 1st July 2023 – 5th April 2024 is known as the transitional period. The profits from this period (transitional profits) are calculated separately.

Next you deduct any overlap profits (you may have paid tax on a portion of profits twice already when you first started up, or if you changed the dates of your business year. they are available to reduce your tax bill). Lastly you can spread these profits (and payment of the tax) over the next 5 years, adding just 1/5 of the total to each tax year.

Example:

Jane Brown Plumbing has Trading profits for 1st July 2022 – 30th June 2023 = £35,000

Trading profits for 1st July 2023 – 5th April 2024 = £25000

Overlap profit carried forward = £10,000

£25,000 (transitional profit) - £10,000 (overlap profit) = £15,000

divided by 5 years = £3,000

so £3,000 will be added to the taxable profits each year for the next 5 years.

Taxable profits for 1st July 2022 - 5th April 2024 =

£35,000 + £3,000 = £38,000

Do I have overlap profits and how do I find them?

If your business tax year has always been different to the standard tax year or you changed to a different date at some point, you could have overlap profits. Overlap is where some of your taxable profits were reported twice on your tax returns, because of the basis period rules.

Again the easiest place to find them is on your last self assessment. Look at the Self-employment (full) pages in Box 70 "Overlap profit carried forward".

If you don’t have an overlap profit shown, it could be worth you looking back through previous returns to make sure it hasn’t been ‘lost’. Used overlap profit would show in box 69 "Overlap relief used this year". If it simply disappears from one year to the next (or your tax return switches from the (full) to (short) self-employment pages) you should still have it available to use. You may need to use HMRC's online service to find the figure. You should talk to your tax agent to confirm this.

*UPDATE

On 11th September 2023, HMRC have released their online service enabling you to get your overlap relief figure. Access the service here: Get Your Overlap Relief Figure.

If you’re not an existing client and you need help to understand how this will affect you, get in touch.

*ADDENDUM On December 19th 2022, Parliament released a statement confirming that Making Tax Digital for Income Tax Self Assessment (MTD ITSA) will be delayed for two further years. Businesses and landlords with annual income above £50,000 will need submit income tax information following MTD rules starting on or after 6th April 2026. Those with income over £30,000 will be mandated from April 2027. This does not affect the dates for Basis Period Reform which will go ahead as planned.

For Reference:

Video: Get help with basis period reform (moving to the new tax year basis). February 2024

Policy paper on Basis period reform. Published 27 October 2021

Previous Blogs

- 15/03/24 Changes to Company Filing - an update

- 07/09/23 Are You Owed Money? What can you do about overdue payments?

- 13/07/23 Changes to Company Filing

- 23/06/23 Overlap Relief is ending

- 28/04/23 Help! I need an SA302!

- 22/02/23 Cashflow in a recession*

- 20/01/23 Getting Ready For Making Tax Digital for Income Tax Self-Assessment MTD ITSA

- 18/11/22 VAT Penalty Reform

- 06/09/22 Accounting Software: What's in it for me?

- 15/07/22 Transitional Year Profits, Overlap Relief and Spreading Profits

- 25/02/22 Basis Period Reform

- 25/01/22 Should I pay Voluntary Class 2 National Insurance Contributions (NIC)?

- 23/11/21 Self assessment: What is payment on account?

- 12/10/21 Why does HMRC need to know about interest on my self assessment tax return?

- 12/09/21 What does a bookkeeper do?